GSR’s research on Solana. Too sweet to be true.

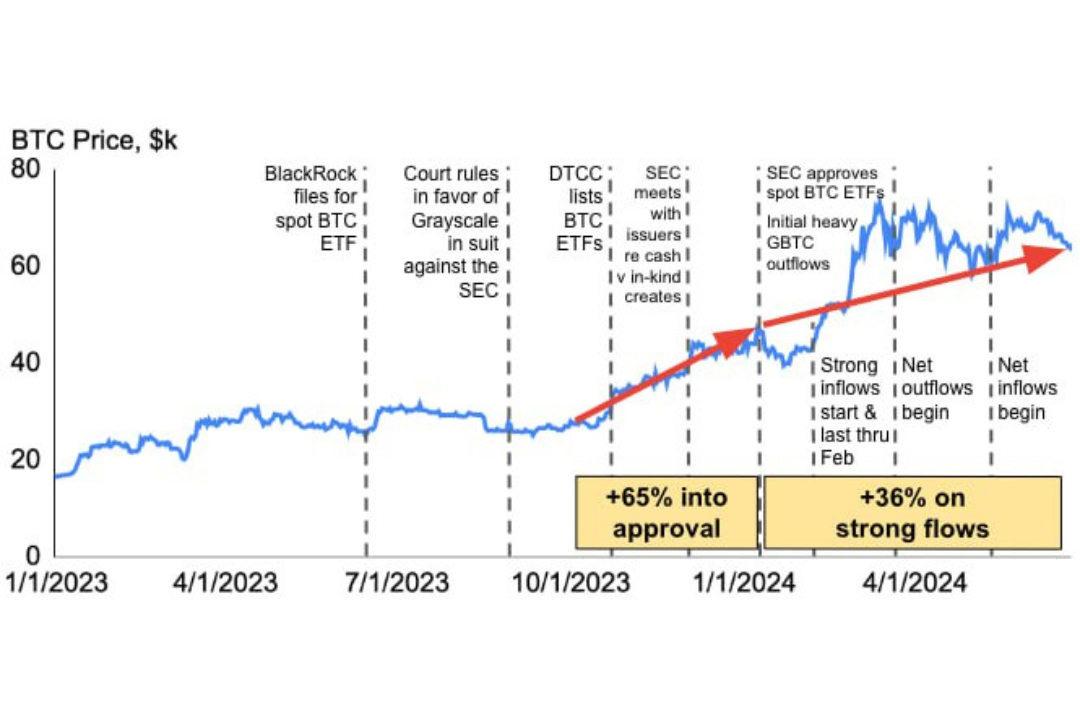

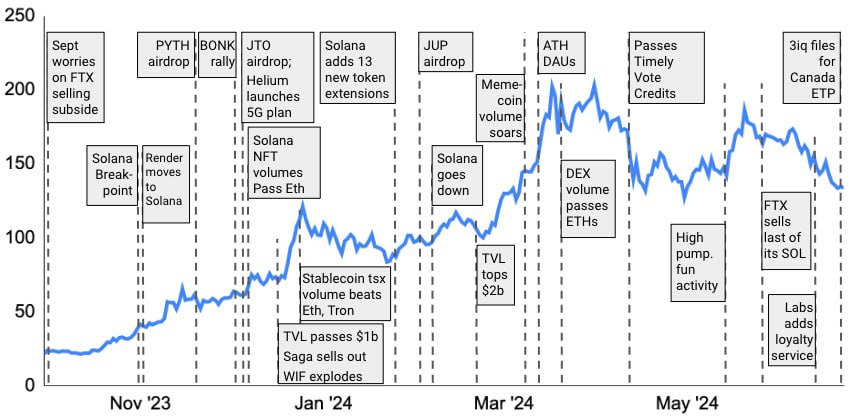

Just yesterday, I pointed out issues and potential problems in the network in the form of fake volumes in Solana, and today SOL and ecosystem tokens have significantly dropped. However, today GSR released a study on Solana, which is overly sweet and encouraging. It is filled with theses that the SOL ETF is just a matter of time and that it will soon become the most successful ETF of all. But their infographics are great; here are two examples of charts, all the news, and price dynamics. Many communities have shared this study, but after examining GSR’s probability assessment system for launching the ETF, I believe it does not deserve the attention it received.

Decentralization as a factor: The Nakamoto Coefficient is a fairly honest assessment method. However, they also include the CCData governance rating, which evaluates the quality of governance, which begs the question of why they need to measure decentralization. Network metrics are a laughable and unreliable way to evaluate Solana. In the end, GSR concludes that if an ETF is launched, SOL’s price will increase by 1.4 to 8.9 times.

With this text, I did not intend to generate negativity towards Solana’s prospects. The blockchain has indeed gained popularity and created a very favorable environment for meme-coins. If you haven’t read it, here’s an interesting material on one aspect of Solana: Why did Solana blockchain win the hearts of meme-coin traders, and why did the boom happen in this network? But I would like to show that one should approach such loud studies with great skepticism. It seems like the goal is set first, and then the arguments are tailored to fit the desired conclusions. The actual study can be found here.