Bitcoin Falls for the Fourth Consecutive Day Amid Rising Stock Prices 📉

Bitcoin has been declining for the fourth consecutive day while stocks of major international companies have reached record highs.

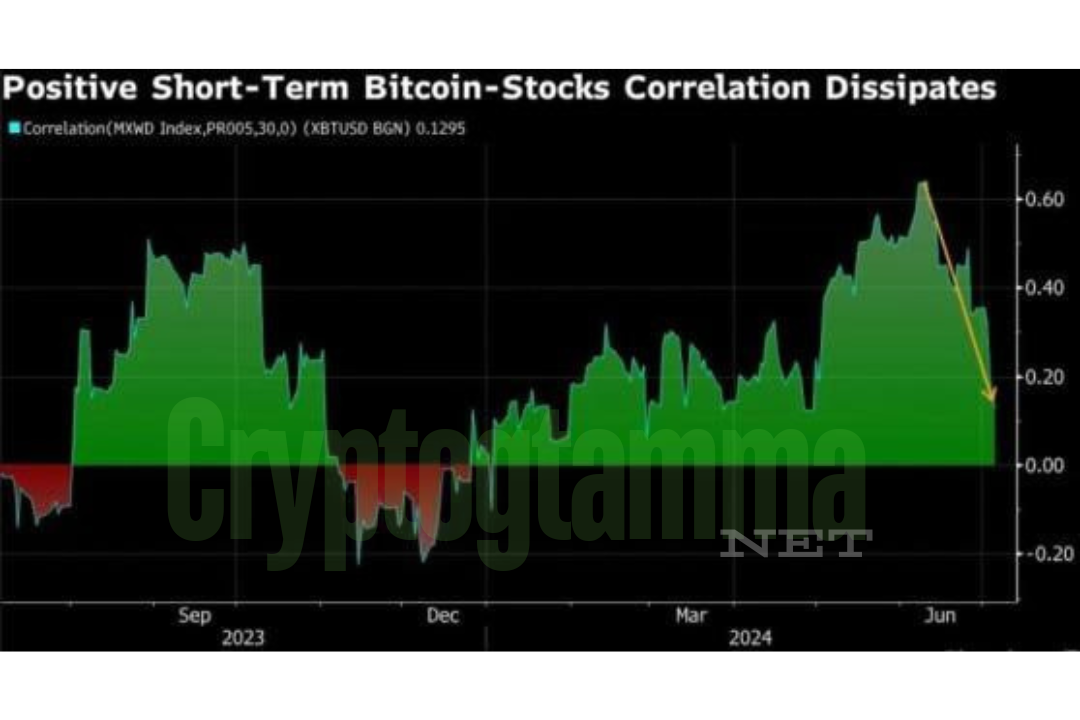

The cryptocurrency’s price began to drop on July 1 and by Friday had decreased by nearly 14%, falling to its lowest level since February 2024 at $55,084 on the Bitstamp exchange. In contrast, the stock prices of many leading companies have been rising, resulting in a 1.6% increase in the S&P 500 index since July 1. This trend has significantly reduced the positive correlation between the changes in stock prices and Bitcoin.

Fluctuations in Correlation Between Bitcoin and Stock Price Changes

Some analysts attribute the dump to investors’ fears of Bitcoin sales by the creditors of the hacked Mt. Gox exchange, which plans to return BTC to them. In total, the company plans to transfer around $8 billion worth of BTC to traders, and on Thursday, the company moved 47,228 BTC, valued at $2.7 billion at the transaction time, from cold storage. This indicates that the coins will soon be transferred to clients.

Current Market Sentiment

Currently, the cryptocurrency market lacks a positive narrative. Most news is inherently negative, such as reports about the possible sale of Bitcoin by Mt. Gox clients. The crypto industry is waiting for two events: a decrease in the key [US] interest rate and an increase in the balance of the US Federal Reserve through the purchase of long-term bonds, stated Stefan von Heinisch, head of the trading department at Singapore’s crypto company OSL SG Pte.