Best Crypto To Buy Now: Secure 50x Returns on Your Investments

Would you like to build a portfolio of altcoins that could give you 10x, 20x, or maybe 50x returns? In this article, I will try to explain which aspects to focus on first to choose the most promising altcoins for investment for your next crypto buy.

Understanding The Market: What You Need to Be Prepared for

First and foremost, I want to emphasize, especially for beginners on crypto market, that there is always a risk of losing your deposit. When we talk about returns of 10, 20, or 50x, it inevitably comes with risks. The higher the potential profit, the higher the risk. See also the ready selection of crypto assets.

If someone claims otherwise, they are either mistaken or intentionally trying to deceive you. If you think the market is meant for everyone to get rich, that’s not true. The market operates in the opposite way: it aims to take money you’ve earned elsewhere, whether from a job or business. You will lose it here, then earn it again and bring the money back to the market.

This article will help you avoid being exploited by the system and instead, earn money in the market.

The biggest risk in cryptocurrency is losing all the money you invest. If you plan to enter the cryptocurrency market and invest in altcoins, you must be prepared to lose all your money. This is not an exaggeration, but a real risk that we must acknowledge. You should not invest funds whose loss would significantly impact your life.

I would like to check your sense of reality and risk perception. You must tell yourself: “Yes, I am ready to take this risk. I want 10-fold growth, and if it doesn’t happen, I am ready to lose everything.” Once we understand this, we can then discuss how to choose altcoins and projects that have the potential for significant growth.

Which coins not to buy. Not Best Crypto to Buy.

So, friends, the first and, in my opinion, one of the most important aspects for those aiming to achieve 10–20x returns on their investments is to avoid projects that have been on the market for a long time. We also don’t look at Bitcoin BTC, Ethereum ETH and meme coins as digital assets in our portfolios. What’s the essence here?

If you take on projects that have already gone through the previous bull market, peaked, and where major funds and investors have exited, and also have a significant number of retail investors—so-called “hamsters”—who were given tokens at the peak, you will find yourself in a less favorable position. Let’s move on to the chart, and I’ll show you what it looks like.

Best Crypto to Buy Now: Avoiding Long-Standing Projects for Higher Returns

Let’s consider the example of the DOT, the native token of the Polkadot network. It is traded on almost all major crypto exchanges. What is notable about DOT? It is a truly impressive and fundamental project. DOT represents a Layer 0 blockchain, which means it is a kind of overlay on top of other blockchains.

What do we observe? DOT started trading in 2019–2020, after which it showed significant growth. We can see that there was first one phase of growth, then another.

Everything seemed great: we grew in the bull market and fell in the bear market. But many miss an important point: at levels of $20–$30 per coin, there are many people who bought these tokens.

And once the price reaches these levels, it will likely break even. What does it mean to break even? It means selling tokens on the market, preventing them from growing further. After that, they will hinder the growth of this project. (That said, I’m sure DOT or ADA was on most of the best crypto to buy now lists last cycle)

Nevertheless, DOT will remain a viable project. It is a reliable and fundamental altcoin, making it suitable for large deposits due to its stability and long-term viability.

Moreover, this project has one of the highest levels of developer activity. But will there be impressive multiples, like 10-20x returns? That is extremely unlikely.

The project should have substantial funding.

Another key point is that the project must be new and start by the end of 2022 or early 2023. It also needs to require a significant amount of money. Preferably from Tier-1, but at least from Tier-2. These should be highly reliable and reputable funds with teams of analysts and access to insider information.

What’s the point? Of course, you can delve deeply into studying a large amount of documentation, become a real geek, and thoroughly understand everything.

But if a major fund investing tens and hundreds of millions of dollars is backing a project, can you really doubt their competence? Do you think such funds would invest in dubious projects? I strongly doubt it.

Of course, we conduct basic research on the project; that goes without saying. However, major funds must initially be involved in the project. If they are not, the likelihood of significant success is greatly reduced. Keep this in mind.

When listing, funds should not have large profits.

This smoothly leads to the third thesis. When a project starts trading on the exchange, funds shouldn’t fixate on 100–200x returns.

Of course, they will see profits, maybe 5, 7, 10, or even 15-20x. For funds, this isn’t a significant amount of money. For an average investor, investing $1,000 and getting $15,000 is a good profit.

But if we’re talking about a fund with teams of analysts, marketers, and lawyers, the fund is more than just a money investment. Especially if it’s a large fund that helps the project with marketing, development, the team, and much more. For them, 10-20x returns aren’t interesting enough. When a project offers 200-300x or at least 50-70x returns, that’s more attractive.

At lower values, these players are unlikely to exit, as they think in the long term and are ready to wait. They want to invest more money. They also want to increase the project’s price. Additionally, they plan to sell assets to retail investors at the highest point to make a profit.

Choosing the Right Altcoin

Now I will explain how to find such projects. Information on how to locate the appropriate funds will be provided towards the end of the article.

Let’s move on to the fourth point. If we are talking about substantial profits, for instance, 20–30x returns, which naturally come with risks, we should consider projects outside the top 50 on CoinMarketCap. These investments do have a larger degree of risk, but they also have a far bigger potential for gain.

CyberConnect Example

Instead of going into basic analysis at this time, I’ll concentrate on an idea you’ll use. Let’s use the CyberConnect project as an example. I have that in my spot portfolio, by the way. CyberConnect ranked 419th in terms of market capitalization a few months ago with a valuation of $78 million.

Let’s imagine a hypothetical situation: the project yields a tenfold profit, and its capitalization reaches $800 million. Let’s see who currently has such a capitalization.

Opening the list of cryptocurrencies, we see that projects with a capitalization of $800 million are roughly in the 80-90th position. If we consider the current market without the influence of a bull trend, CyberConnect could fall into this range. However, if a bull market starts, the overall growth will pull other projects up, and it’s likely that CyberConnect won’t even get close to the 100th position with such a capitalization.

What are the chances that CyberConnect will enter the top 100 by capitalization, given the support of top funds and market maker DWF Labs? Quite high, even without considering a possible bull trend.

Arbitrum Example

Arbitrum Project: Evaluating Prospects.

I want to note that I am an Arbitrum holder myself and consider this project genuinely interesting and promising. However, the likelihood of it growing 10-fold is somewhat lower. Why? Currently, Arbitrum’s market cap is $3 billion. To achieve a 10-fold increase, the market cap would have to reach $30 billion, which requires significant efforts. For those considering a crypto buy, it’s essential to evaluate such growth challenges carefully

It’s worth mentioning that many people have profited significantly from Arbitrum airdrops. If you’re not familiar with this or unsure how to benefit from it, read here.

For comparison, for Cyber to grow 10-fold, its market cap needs to increase from $80 million to $800 million, which is quite feasible. In the case of Arbitrum, to achieve 10-fold growth, the market cap would need to increase from $2.3 billion to $23.5 billion—this sounds less likely, don’t you agree? This makes Cyber a more attractive option for a crypto buy if one seeks higher growth potential.

In this example, I want to emphasize not so much the figures of these coins as the principle of their evaluation.

If a project is ranked highly on CoinMarketCap, on the one hand, it is more reliable, but on the other hand, its potential for significant growth is probably lower. However, do not go to extremes and look for dubious projects among the top 500 or top 1000 on CoinMarketCap. No, not at all.

If you want to reduce risks, choose more reliable projects with high market capitalization and lower volatility. If you are aiming for higher profits and are ready to take risks, consider more volatile projects with potentially high growth(not extreme volatility of course).

Project Tokenomics and Unlock Schedule for Funds

Our main task is to understand when the major tokens will enter the market. Ideally, this should happen during a bull market to avoid a major unlock all at once, and instead, have tokens released evenly throughout 2024, 2025, and 2026.

Where can we find this information? We go to the CryptoRank service, where there is a Vesting tab. For example, using the CyberConnect project as an example, we can see how the tokens will be released into the market. The information can be viewed in the format of a timeline or a chart, and you can also find out who will have how many tokens unlocked.

If you have chosen a solid project by analyzing the funds and the team, and it was listed at the end of 2022 or the beginning of 2023, this issue has most likely already been addressed. It is important to know who is behind the project.

Big investors will not allow tokens to be unlocked in a down market. This is because it would decrease their profits. They are supporting the tokens.

Market Cycle

Understanding market cycles is crucial, and this is a key point you need to grasp. If you have ever experienced a bull market, you know that when everything is growing, it’s very easy for people to buy.

Best Crypto to Buy Now: Navigating Market Cycles for Optimal Entry

Hope, belief in growth, euphoria—all these emotions are quite normal for any investor or trader. However, it is advisable to make decisions without relying on these emotions; otherwise, you risk becoming that holder who buys assets at their peak.

Remember, we discussed the project you bought at $30, $40, and $50, and eventually sat in losses for a long time, preventing the project from growing. Your task is to enter the market when there is fear, panic, or depression and no one else wants to get involved and fiat currency is in no hurry to enter the market. Weak hands, on the other hand, are selling cryptocurrency.

When were such periods for Bitcoin? Let’s take a look.

Speaking of the previous cycle, first, there was an accumulation period in 2019–2020. Then the chart starts to rise, surprisingly. After this, naturally, comes the bear market and the decline. For the last one and a half to two years, we have observed a bearish trend. During this period, accumulation was happening, and now the chart is showing growth again. What do you think? Is it worth a crypto buy under these conditions?

Personally, I believe it’s worth it because we are either on the brink of a bull market or already in one, just not fully realizing it yet. From the perspective of market cycles, as of June 1, 2024, everything looks great.

This doesn’t mean that growth will be continuous and rapid. We might drop by 30, 40, or even 50 percent—that’s completely normal. The risk of intervention by the Securities and Exchange Commission (SEC) has risen compared to the past, yet the market remains ripe with opportunities. Decentralized applications and smart contracts are expanding annually, with “one in three” internet users now familiar with peer-to-peer technology. Additionally, exchanges profit significantly from trading fees, and major players are unlikely to permit any substantial reduction in their revenues.

It’s important to understand which stage of the cycle we are in. After experiencing the bull market of 2020–2021, we went through a downturn, a bear market, consolidation, and accumulation. Now, growth is beginning.

It makes sense to enter the market after a decline, accumulation, and the start of growth. If you think the current Bitcoin price of around $60,000 is too high, let’s revisit this question in a couple of years.

Project Applicability and its Team

So, we have reached the seventh point, which, although less important, still deserves your attention. When gathering information about a project, it is important to assess its practical applicability and the presence of genuinely interesting new technologies. We’re talking about crypto assets like Cardano ADA, but younger. By the way, most of them currently operate on proof of work.

Pay attention to the team and their experience; this is critically important. Newcomers with little experience in blockchain development and no successful cases should not lead the project. They lack understanding of life and business.

The way the token is used is also important. The token should have a real and interesting practical application, as well as factors that create demand for it. My young cryptocurrency fans already know that if a project is in demand, its price will go up. If there is no demand and the supply comes only from funds that were invested earlier, it is obvious what will happen to the token prices.

How to Choose Altcoins: A Practical Guide

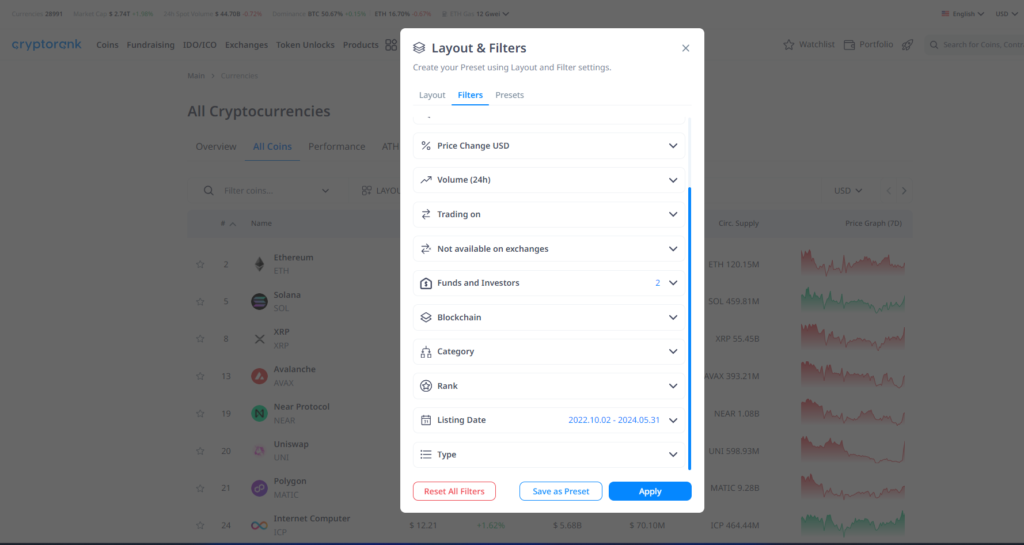

Now let’s move on to practice. I will show you how to search for leading funds and check their listing dates, as well as what to pay attention to in terms of capitalization, based on everything we’ve discussed. To do this, go to the CryptoRank website.

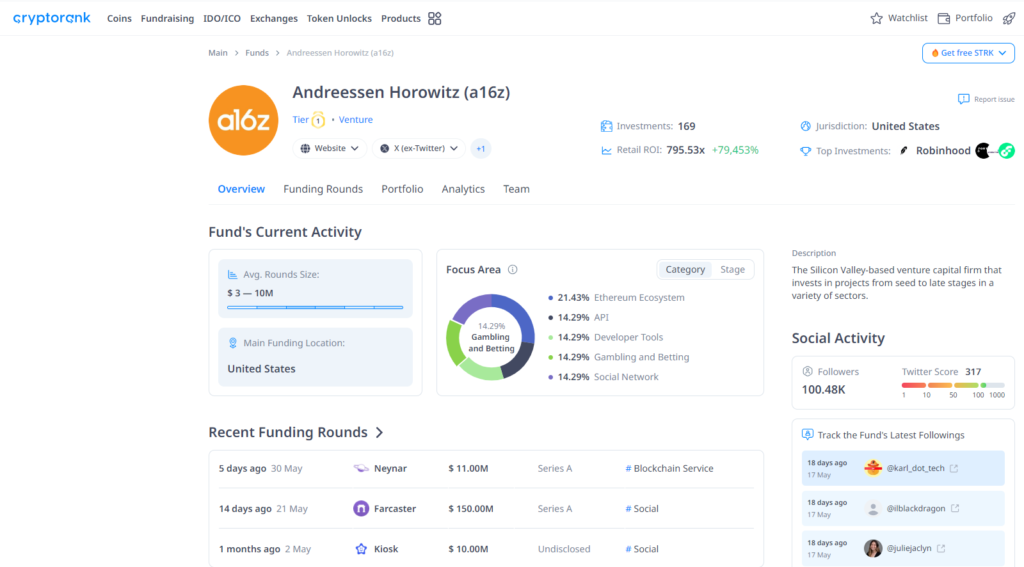

If we want to see the major top funds and understand where they have invested, we can go to the “Fundraising” tab, then open the “Funds” tab. Here you will see the leading funds and the amounts of their investments, such as Andreessen Horowitz, Polychain, Pantera, and others.

Here we can move on to the example of Andreessen Horowitz to see where these guys have invested, at what stage, how much money, and so on. You can make a list of funds you are interested in and want to monitor. Then go to the “Coins” tab and use the filters to find the projects you need.

Let’s say you want to make investments in projects supported by top funders like Sequoia and Andreessen Horowitz. These funds carry out extensive research, and their initiatives often provide positive outcomes and are long-lasting. As we’ve previously established, we are not interested in really old projects, therefore, let’s also specify the listing term. Let’s look at projects that were announced between October 2022 and June 1st, 2023.

Criteria for Selecting Promising Crypto Projects

Thus, the two most important search parameters that we have determined are the existence of renowned investors and the listing date within the given timeframe. To see a list of projects that the chosen funds have invested in, click “apply”.

We can immediately assess their potential returns and, with just a few clicks, review the projects that meet our criteria. Naturally, to increase the number of projects, we can expand the list of funds or go to a specific fund and study its investments in more detail.

Best Crypto to Buy Now – SUI

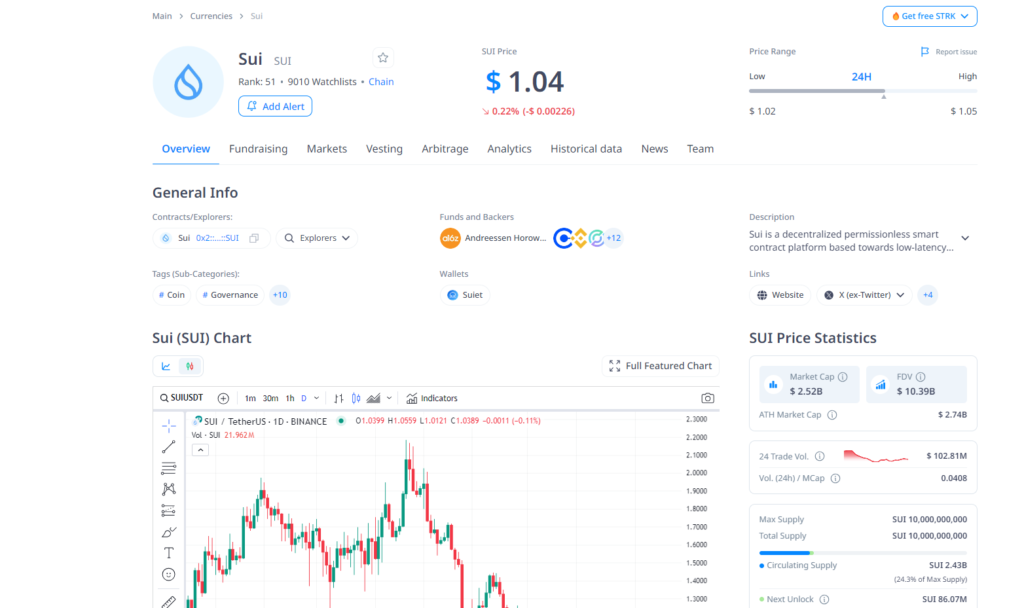

Let’s take a look at the SUI project as an example. SUI is an interesting project that I will discuss in detail in future articles. Currently, it ranks 51st in market capitalization. For comparison, when its price was 60 cents, it was ranked 100th.

This is the point I mentioned earlier. SUI and Aptos are very similar blockchains. If you are already familiar with cryptocurrencies, you’ve probably heard of Aptos.

Aptos initially has a higher market capitalization, making its growth more challenging. Aptos is harder to provide significant returns compared to SUI, and this is important for investors to understand.

Personally, I have a positive outlook on both Aptos and SUI, and I hold both assets. However, SUI initially had a more promising idea, despite prolonged adjustments. You can see that this is a fresh chart without old holders. During the “bear” market, we dipped a bit, but it’s not critical.

Next, in the “fundraising” tab, you can see which funds were invested at which stages, what funding rounds took place, and so on. Sometimes we can even see how many returns SUI investors have received. IEOs were held on various platforms, such as OKX, Jumpstart, and Bybit. It’s clear that investors there make significant returns, but it’s worth noting that the amounts were generally several million dollars.

Why SUI is Considered One of the Best Crypto to Buy Now

The most interesting part is the funds that come in with hundreds of millions of dollars. Obviously, such information rarely becomes public. How can you determine the price at which they invested?

For this, you can use various services, such as DropStab. With its help, you can find out how many tokens the funds acquired and estimate how much they invested – what are the best crypto to buy according to the opinion of the funds. By dividing one by the other, we get the price at which the funds entered the project.

If you see 10-20x returns, it shouldn’t be too concerning; 100x returns raise questions. But 10-30x returns are quite reasonable.

You can also look at the “Vesting” tab for SUI to find out when tokens will be unlocked for the market. Since SUI is a good project with solid funds, the tokens will be locked for a long time. You can find this information on the timeline or charts, whichever is more convenient for you.

In this article, I have provided you with the essential criteria I use to select altcoins for my investment portfolio. By adhering to my recommendations, you can significantly enhance your chances of profiting in the cryptocurrency market. Additionally, ensure you stay informed about the news and updates related to the projects you have invested in.

FAQ: Portfolio Creation: Crypto to Buy Today

Investors and traders often use the term “best crypto to buy now” to refer to the most suitable digital currency to invest in at the current time.

The term “best crypto to buy now” implies that it is about choosing altcoins that can yield high returns based on the existing market environment, tendencies, and analysis of fundamentals. These are typically new or emerging projects with high growth potential.

What are the hazards that come with the quest for high returns when investing in cryptocurrencies?

Buying into cryptocurrencies, especially those that have the possibility of giving returns of 10x to 50x comes with significant risk. This is the risk that you may end up losing all your investment resulting from market fluctuation, changes in regulation or a project that goes bust. One should always play only with the money that he or she is willing to part with in case of a loss.

Why should long-standing projects be eschewed in a bid to reap higher returns?

Large-scale projects tend to have well-established market dominance and a broad base of retail investors, which can act as a restraint. Some could have already reached their growth in prior bull runs and that makes it difficult to make high returns as with other projects.

What factors should one consider when choosing the best crypto to invest in now if he or she wants to avoid the old coins?

Searched for projects that initiated after October 2022. Target those that are invested by potentially great investors like Sequoia or Andreessen Horowitz because they are likely to have done their homework and provide help, making it more likely that you will get good results.

What factors should you consider in a new crypto project to determine that it deserves to be the best crypto to buy now?

Some of the key factors are large funding from reputable sources, the use of new technology or applications, and a defined roadmap to expansion. Do not invest in those projects that are already generating incredible revenues for initial investors because growth potential in such projects may be limited.

In what way can the market cycle help in identifying the most appropriate cryptocurrency that one can buy at the time of investment?

They also help one in identifying when to enter a given market. Buying during the time when everyone is in a state of panic or buying equities can be very profitable especially when the market attains its bull phase.

What kind of considerations are there to be made when it comes to the investment and the tokens and vesting schedules of the project?

You should also check the tokenomics to understand the distribution and any potential supply pressure. To find out when the tokens will be released in large quantity, it is essential to consider vesting schedules. Tokens, on the other hand, need to be released gradually over time to avoid any fluctuation in the market.

For this reason, SUI is one of the most favorable digital currencies to invest in the current time.

SUI is a good project at the present moment and it has the 51st in terms of market capitalization. Although it is regarded as relatively young, it enjoys strong backing from some of the top funds and market makers. Due to this, it can be said that it is a better investment than the other old projects that have few holders and low growth rate.

You need to know how one can be confident that the funds that are used in the backing of a project are genuine.

It can be possible to estimate the credibility of funds on the basis of investments made by them and the returns earned by them. For example, one can use CryptoRank or DropStab to know the amount of money that big players have invested in the project and how it affected the project.

What strategies can be taken into consideration to maximize the performance of the best cryptocurrencies to invest in today?

Further diversification, by investing in new promising projects as well as investing in more established, reliable cryptocurrencies. This balance will help one in avoiding or reducing the risks on the other hand it will enable one to capture higher returns. This means that one has to be very careful and keep an eye on the market to make sure that what one has in his or her portfolio is appropriate for the market.