Binance Staking – Stake 14 Different Coins

Highlights

Pros&Cons

Pros

- 14 assets can be staked

- Various terms and yields on offer

- Also supports yield farming and interest accounts

- The ability to assemble a portfolio in one interface.

Cons

- Losses due to misconfiguration

- Low APY

- Some staking pools sell out quickly

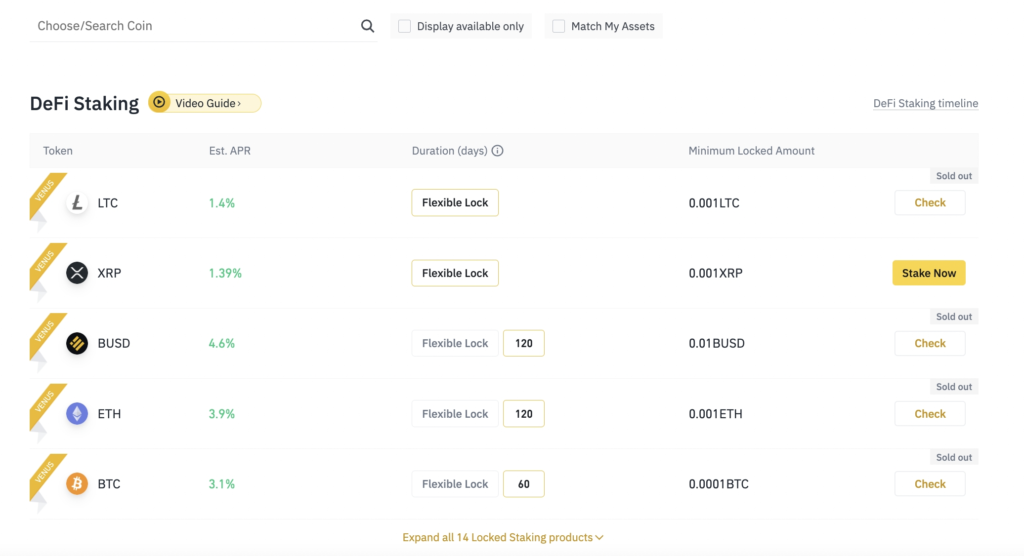

The Binance ecosystem now consists of the world’s largest crypto exchange for trading volume, a top-5 digital asset by market capitalization, and a fully-fledged facility for earning passive income. As of writing, the Binance staking tool supports 14 coins. This includes everything from BNB, AAVE, and Ethereum to XRP, Litecoin, and Bitcoin.

Yields vary depending on the coin, albeit, the highest interest rate as of writing is being paid on DYDX at 8.7%. Some staking coins come with flexible withdrawal terms, while others require a lock-up period of up to 120 days. It is possible to earn an even higher yield by opting for a Binance interest account. Axie Infinity, for example, on a 90-day term yields an APY of 76%.

In addition to offering interest-bearing products, Binance is one of the cheapest crypto exchanges in this space. Buying and selling crypto will cost just 0.1% per slide here. Binance supports more than 1,000 markets, which includes many of the best meme coins for speculative investors. Binance also lists a range of fast-growing cryptocurrencies from the BSc network.

Learn more about staking platforms: Staking Platform