Solana Staking – The Ultimate Guide in 2024

Indeed, staking is part of the core of PoS-based blockchain networks in the world, such as Solana. It is a process of staking a fixed number of coins to facilitate network running —for instance, the verification of transactions and the process of maintaining security features. Solana Staking (SOL) allows token holders to participate in blockchain operations while earning rewards simultaneously.

Key points:

- Speed and Scalability of Solana: This blockchain network is quickly gaining popularity in high speed and scalability.

- Staking Model: Delegates the SOL tokens to the validator nodes, which are in turn verifying the transactions and sustaining the network.

- Staking process: Validator selection, token delegation, and reward collection.

- Advantages of Staking on SOL: A passive reward that allows you to earn while helping to secure the network and grow conductively in decentral.

- Risks: Penalties, market volatility, and technical failures.

- Technical Requirements for Solo Staking: High-performance hardware and knowledge of blockchain technologies.

- Conclusion: You can stake Solana for income and network support, but it requires technical knowledge and a willingness to take on risks.

What Is Solana Staking?

Staking is an integral part of PoS based blockchain networks such as Solana. It entails staking a fixed number of coins to facilitate the running of a network, for instance, verifying transactions and maintaining security. Solana Staking (SOL) allows token holders to engage in blockchain operations and earn rewards.

The Solana blockchain is also relatively new but has been experiencing massive adoption due to its high speed and scalability. It is set to become Ethereum’s main rival in 2024, providing a solid infrastructure for decentralized applications (dApps) and DeFi solutions.

The staking model of Solana provides incentives to the users who delegate their SOLs to validator nodes in the form of a cut of newly minted tokens and transactions fees. These nodes are involved in verifying transactions and also in the maintenance of the network. The more votes a validator receives, the more of a say it has in the consensus mechanism.

The Solana Staking process is as follows:

- Assign your tokens to a compatible crypto wallet connected to a validator node.

- “Vote” for a node you trust.

- Receive rewards in the form of new coins and commissions proportional to the amount staked.

You can manage staking wallets and validators independently or through third-party services like staking pools.

Key benefits of SOL Staking include:

- Passive income

- Contribution to network security

- Support for decentralization

However, there are also risks, including financial penalties, market volatility, and technical failures. Solo staking requires advanced equipment and skills, while third-party services are easier but may come with fees.

Thanks to its unique Proof-of-History and Proof-of-Stake algorithms, Solana is rapidly gaining traction. Competent SOL staking allows you to capitalize on this growth, helping to maintain a promising crypto network.

An Introduction to Solana Staking

Quick Reference for Beginners

For those who started following the Solana blockchain recently, it is necessary to familiarize oneself with some basic knowledge. Solana employs a consensus mechanism that is a combination of PoS and PoH, making it capable of handling a large number of transactions per second and with a low delay.

Proof-of-Stake (PoS) and Proof-of-History (PoH)

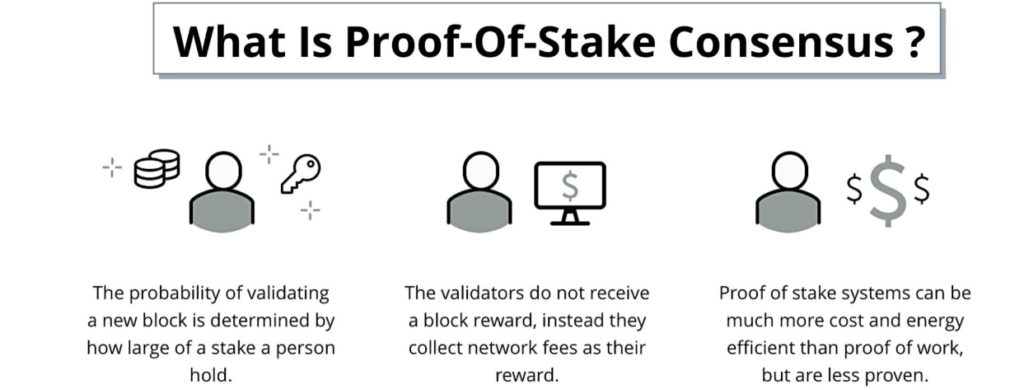

- Proof-of-Stake (PoS): In PoS, the validators are selected to generate new blocks according to the number of tokens they own and are willing to risk.

- Proof-of-History (PoH): PoH works as a cryptographic clock, which can help scale things even further by providing a timeline that proves that certain events have happened in a certain order.

How Staking Works

Validators and Delegators:

- Validators: These are nodes that confirm transactions and generate new blocks of data. They must host specialized hardware and maintain near-constant availability. For instance, Binance, Kraken, Coinbase, Chorus One, Lido, and many more.

- Delegators: These are users who delegate their SOL tokens to the validators in exchange for a share of the rewards.

Staking Rewards

- New Tokens: Validators and delegators earn newly minted SOL tokens.

- Transaction Fees: The network uses a portion of the transaction fees to incentivize users.

Detailed Explanation of Staking

Staking is a process of investing in the Solana network and getting a passive income from it, as well as contributing to the network’s security and functionality. Unlike mining, staking does not need much computational power, but it involves holding and freezing tokens in a wallet. It is the most advanced technology for verifying transactions on the blockchain, which requires many times less power to operate, thus reducing damage to nature.

You can read more about staking here

Solo Staking

Benefits of Independent Staking

Independent staking offers several advantages, including:

- Greater Control: You have full control over your staked tokens and the choice of validator.

- Increased Rewards: There are benefits to being an independent staker, for example, no intermediary fees and potentially higher rewards.

Requirements

Technical Expertise

It is important to note that the establishment of a validator node entails some level of knowledge in blockchain, networking, and server management.

Hardware Setup

- High-performance CPU: To handle transaction processing.

- RAM: At least 128GB.

- Storage: SSDs with high read/write speeds.

- Bandwidth: High-speed internet connection.

Steps for Setting Up a Validator Node

- Install the Solana CLI: Download and install the Solana command-line interface.

- Configure the Validator: Set up the node with the appropriate configuration files.

- Start the Validator: Initiate the node and connect it to the Solana network.

- Stake SOL: Delegate your SOL tokens to your validator node.

However, it is worth saying that this option will not suit everyone for obvious reasons. Not only will you need to invest considerably more of your time in it when steaking on your own, but the monetary entry threshold here is much higher.

Staking Services

Staking pools are pools where many users share their SOL tokens, which increases the probability of being selected as validators and earning additional rewards.

Staking-as-a-Service Providers

These providers handle the technical aspects of staking for you, typically in exchange for a fee. For example:

- Figment: Offers managed staking services.

- Chorus One: Provides secure and reliable staking solutions.

- and others, choose the best option in our review

Custodial vs. Non-Custodial Wallets

- Custodial Wallets: Managed by third parties, these wallets offer convenience but limit user control. Your private keys are held by a third party, such as an exchange or a staking service provider. This third party oversees your funds and has direct access to your financial resources. Your security and asset availability depend on the service provider. Notable examples of centralized exchanges offering custodial services include Binance, Coinbase, and Kraken.

- Non-Custodial Wallets: These wallets offer full control of your funds, which significantly increases security. You control your private keys, which are stored on your local device, ensuring that no third party has access to your assets. You are fully responsible for your funds, and no third party will be liable in case of loss. Some of the examples of Solana wallets include Solflare, Sollet, Phantom, and more decentralized wallets.

Benefits and Risks of Solana Staking

Benefits

- Passive Income: SOL staking can provide a non-discretionary source of reliable, seamless, passivity income, subject to active management if one decides to stake independently.

- Growth Potential: The rapid growth experienced by the Solana network might escalate staking rewards, therefore representing a very profitable long-term investment.

- Network Security: Stake strengthens the safety, stability, and decentralization of the Solana network by keeping its participants honest and validating transactions.

- Community Involvement: High participation in staking allows more people to have a say in the governance of the network, making it more decentralized and secure.

Quick fact

As of May 2024, the average annual percentage yield (APY) for Solana staking is about 7.35%.

Primary Risks

- Technical Failures: Even on reliable blockchains like Solana, technical failures are bound to happen. The last incident proved that there is no guarantee to recover your tokens in such a case.

- Market Volatility: As a matter of technical problems, sometimes the price of SOL can go down, and it may be impossible for you to access your coins then.

- Problems of centralization: Solana intends to be a global network but is underdeveloped and relies on a small set of validators, leading to concerns about a lack of decentralization. If a small team of validators had the ability, it could do things like alter network rules, have an unfair imposition of penalties, or control the network for their own benefit at the potential expense of undercutting other validators.

Real Life Examples of Misconduct

- Collusion: Validators may collude by preventing others from receiving shared rewards or unfairly strengthening their power.

- Power abuse: if the slashing rule is misused, it can lead to unfair penalties or manipulated votes, thereby destroying the fairness and integrity of the network.

Factors to Consider When Choosing a Staking Method

- Level of Technical Expertise

The level of technical competency is one of the most important aspects that you have to consider when deciding on the staking method to adopt. Validator or being in complicated staking schemes need to know about the blockchain, network, and server security. If you do not have sufficient technical background, it would be more advisable to go for staking pools or staking service providers. If you are not familiar with most of the information presented in this article, I suggest that you go for the latter. - Initial Investment Size

Another consideration is the initial capital that is required to start the business and undertake the necessary operations. It is very expensive to launch your own validator, as you need to invest in equipment and have regular expenses for its maintenance. On the other hand, staking in a pool or with a staking service provider may cost less, as you combine resources with other stakers. - Time and Effort

Think about how much time and energy you are willing to dedicate towards the staking process. Having your own validator is not always easy because it needs to be monitored and administered all the time, which can take a lot of time. However, when you stake your coins using a provider or pool, it will take much of your time, and you will have more leisure time. - Level of Control Over Assets

Think about how much control you want over your things. If you use others to hold your assets, it might be less safe. If you want full control, use your own wallets.

Risks and Rewards - Potential Risks and Returns

Low fees and big rewards might look good, but think about the dangers too. Tech troubles and past issues should be on your mind. Find a balance between risk and reward. - Community and Reputation

Look for a strong community and good reputation when picking a method. Make sure the group you pick is known and has good support.

A wide view of these factors will aid your choice of the best method for your needs and funds.

Choosing a Platform for SOL Staking

As mentioned, there are currently several platforms for SOL staking: custodial wallets (Solflare, Ledger), blockchain explorers (Solana Beach, Solscan), staking pools (Staked, FTX), and running a validator on your own. Consider the measures to protect your information and technical assistance provided by the service as these factors will allow you to cope with the problems and non-standard situations. Of course, compare the rates on different platforms, but remember that the cheapest option is not always the best – as it is stated in the proverb “You get what you pay for.” You can find a more detailed review here.

Earning Solana Staking Rewards

When will you get your first rewards?

Bonuses are paid daily but are structured around epochs, each lasting approximately two days. During each epoch, the system performs various operations and incorporates new data. This regular distribution ensures participants remain motivated and rewarded based on their performance and efforts within the network.

Estimating Yield

Yield depends on the network conditions and the performance of the validator that may change due to the various reasons like congestion level of the network and the efficiency of the validators. Additionally, you can check the current APY rates on staking platforms, which regularly update the rates based on current conditions. As of now the average APY is 7. 35%.

Penalized Behavior

Misbehavior or excessive unavailability can result in validators being punished, leading to a reduction in their staked tokens.

Staking and Unstaking SOL Tokens

Warm-up and Validation Periods

Newly staked tokens are initialized and then become live. In any of the staking methods, the staked SOL will not be available for the validator node immediately and it may take several days or weeks. After that, the tokens must be held in the Solana network for the minimum validation time to ensure that they are valid. SOL can be unstaked anytime to keep funds liquid, but they are locked for around 2-3 days during the cooling period.

Summary: SOL staking also has time-staged phases of warm-up, validation, and cooling, during which the coins are locked. However, they can be withdrawn at any time, but this shall be after observing the cooling period.

Staking vs Other Investment Options

Comparison

- Staking: Offers passive income and network participation but comes with certain risks.

- Yield Farming: Higher potential returns but significantly higher risk.

- Trading: High-risk, high-reward strategy requiring constant monitoring.

Future of Solana and Staking

Speculation on Developments in 2024 and Beyond

- Increased Adoption: As more projects build on Solana, staking will become more lucrative.

- Technological Advancements: Improvements in PoH and PoS could further enhance scalability and security.

- Regulatory Landscape: Evolving regulations will shape the future of staking.

Conclusion

Summary of Key Points

Therefore, if you are still interested after reading this article, staking Solana can be a good option. Solana is a growing and promising network, but it has drawbacks. First of all, you need to decide what kind of crypto enthusiast you are and how much time you are ready to devote. However, it is important to note that Solana’s price is highly volatile, and investors should be aware of the risks that come with investing in this cryptocurrency. Solana established itself as a distinct altcoin during this bull market, which contributed to its early growth. However, this means its growth phase might end before other altcoins experience similar growth, so keep this in mind.

Also read: Algorand [ALGO] Staking: What You Need to Know to Get Started

Profitability Factors

The profitability of betting being a business depends on several factors. Network stability is vital since a well-connected network can result in more stable rewards. Validator selection is also crucial as selecting good and high-performing validators can help in achieving maximum profitability. Here are the 12 best Solana steaking platforms we have reviewed based on the rates and terms and conditions. Also, the final profit will depend on the price of the solana token itself, because the interest you receive is not in dollars or euros, but in the token you steak. If you are not sure about the price of the token or maybe you just don’t understand why crypto is rising or falling in a particular period, I personally wouldn’t recommend you to freeze your assets for a long time.

We also recommend that you read about a time-tested and personally verified method for finding altcoins that can yield over 1000 percent profit.