APR vs. APY in Crypto: How to Calculate and Compare

Understanding APR and APY in Crypto

When investing in cryptocurrencies, knowing certain financial ratios is crucial for making informed decisions. Two such metrics that often cause a lot of confusion among investors include the APR (annual percentage rate) and the APY (annual percentage yield). Understanding the difference between these two is very important, especially when it comes to investments and their yields.

This article explains APR and APY, their calculations, and why distinguishing them is crucial, especially in cryptocurrency contexts.

Defining APR (Annual Percentage Rate)

What is APR?

APR, or annual percentage rate, measures the cost of borrowing or return on investment without considering compounding effects. It is stated in terms of percentage and is a useful tool for calculating the yearly cost of a loan or the yearly return on an investment.

For instance, if the annual interest rate is 5%, then an investment of $100 will generate an income of $5 in one year. On the other hand, if you borrow $100 at the same interest rate, you must pay back $105 in one year.

This helps determine the interest amount paid when borrowing money or the amount an investor will receive.In the context of credit cards, it is important to note that APR is not usually applied when using the card, but the balance is paid in full before the due date. But if there is still a balance to be paid and the due date is reached, interest is charged at the end of each billing cycle.

Using APR on Loans and Investments

APR is a standard in traditional finance, used to denote interest rates on loans, credit cards, and mortgages. For instance, if you borrow $10,000 with an annual percentage rate of 5%, you will pay $500 in interest per year.

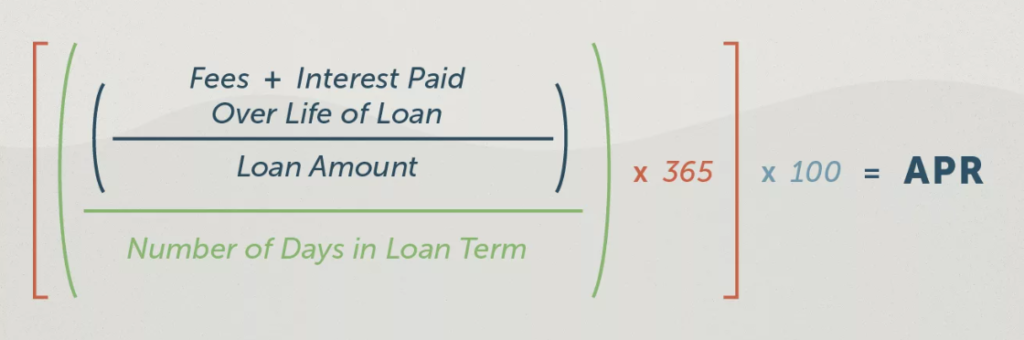

Example Calculation of APR

Imagine you invest $1,000 with an APR of 10%. At the end of one year, you would earn $100 in interest.

APR in Cryptocurrencies

Using APR for Lending Cryptocurrencies

In the crypto market, APR commonly refers to potential earnings from lending digital assets. You can do this through centralized exchanges or decentralized finance (DeFi) platforms by lending your tokens and earning interest on them.

APR is the standard interest rate charged on the principal amount of an investment or loan. Since APR stands for annual percentage rate, proportional interest is charged for shorter periods. For instance, if an investment is made for six months with an annual rate of 5%, the return will be 2.5%. The interest rate is 5 percent of the principal amount.

APR is very straightforward. For instance, consider an investment of 1. No Ether (ETH) in a lending pool in the decentralized finance (DeFi) network. If the stated annual interest rate is 24%, then. The expected return on the initial investment would be 24 percent if the investment is locked in the pool for one year. Thus, the investment should now be equal to 1.24 Ether, including 1. There was no Ether remaining in the principal, and no Ether has been earned. 24 percent in interest if calculated on the basis of 24% per annum.

Example of APR in DeFi

Suppose you lend 1 ETH on a DeFi platform offering a 12% APR. At the end of the year, you would receive 0.12 ETH as interest.

Interest=1 ETH×0.12=0.12 ETH

Defining APY (Annual Percentage Yield)

APY, or Annual Percentage Yield, measures how much money can be earned on an interest account over a year. In cryptocurrency, APY refers to the yield of investments.

What is APY?

APY, or annual percentage yield, is the actual annual return on an investment, compounded with interest. While APR gives a clearer understanding of the actual annual income since it includes the interest compounded annually.

While APR calculates interest based on simple interest, APY considers compound interest. Compound interest means calculating interest on both the original deposit and the interest already earned. That is why APY is better than APR.

Investors can earn APY by staking their coins and using yield farming to provide liquidity to liquidity pools to earn returns. They can also get APY by staking their coins in savings accounts.

Investors can earn APY on their bitcoins through crypto exchanges, crypto wallets, or decentralized finance protocols. The interest is usually paid in the same currency as the cryptocurrency used to make the investment, although there are cases where a different currency is used to pay the interest.

Using APR and APY in Crypto Savings and Yield Farming

APY is especially helpful for cryptocurrency savings accounts and yield farming since it compounds interest. This means you earn interest on both the initial deposit and the accumulated interest.

Example Application of APY

If you deposit $1,000 in a crypto savings account with an APY of 10% and the interest compounds monthly, you would earn more than $100 in interest by the end of the year due to compounding.

Calculating APY

Compound interest can be calculated daily, weekly, monthly, annually, or continuously.

APY is a bit more complicated than APR because it involves calculating compound interest on the principal amount. And then accruing interest on this amount over a certain period of time.

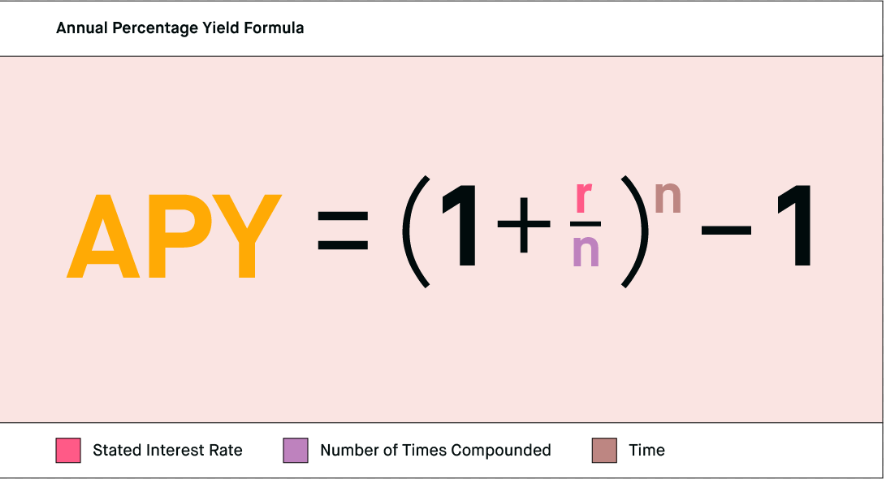

Formula for Computing APY

APY = (1 + r/n)n – 1

For instance, you invest an initial capital of 1000 coins at a compound interest rate of 10%, with the interest compounded daily. The following calculation reveals that within a single year, the total number of units will be 1105. In the next year, it should be 1221. It rises as the time of holding it increases and also with high interest rates.

Every time the calculation is updated, the interest should be added to the initial capital plus interest. However, what does 10% APY imply in the context of cryptocurrency?

Most cryptocurrency projects offer only 1% APY, but some offer 7% on flexible accounts, such as Phemex for Tether (USDT). In the case of fixed savings accounts, they can reach 10%. There are also DeFi platforms such as PancakeSwap (CAKE) and SushiSwap (SUSHI). That are said to offer investors very high APYs, exceeding 100%.

Difference Between Simple and Compound Interest Accrual

- Simple Interest: Interest is charged on the principal amount only and not on the total amount that has been borrowed.

- Compound Interest: Interest is calculated on the principal amount as well as on the interest that has already been charged.

Example Calculation of APY with Daily Compounding

For an investment with a 10% APR compounded daily, the APY can be calculated as follows:

For example, if the APR is 10% and the interest compounds daily, the calculation would be:

APY=(1+0.10365)365−1APY=(1+3650.10)365−1

This results in an APY of approximately 10.47%.

Alternatively, in plain text:

For example, if the APR is 10% and the interest compounds daily, the calculation would be:

APY = (1 + 0.10/365) ^ 365 – 1

This results in an APY of approximately 10.47%.

What Does the 7-Day APY Mean in Cryptocurrency?

A 7-day APY represents the annualized yield based on the interest earned over a seven-day period. It gives investors an idea of the potential annual returns if the weekly rate remains constant.

Key Differences Between APR and APY

Both APY and APR are used to calculate interest on crypto investments and loans. However, they are not the same.

- APR Excludes Compound Interest: APR only considers simple interest, whereas APY accounts for compound interest.

- APY is Always Higher: Given the same initial conditions, APY will always be higher than APR due to the effect of compounding.

- Application for Borrowers and Investors: APR is more relevant for borrowers as it indicates the cost of borrowing, while APY is crucial for investors as it reflects the true return on investments.

The annual percentage yield refers to the amount of interest earned in a year, while the annual percentage rate is the amount that must be paid as interest. When comparing the yields of APR and APY, assuming all other factors such as principal, interest rate, and investment period are the same, the key difference is compound interest.

It represents the total income, including the amount earned from interest and principal investments. Since APR does not account for compound interest, APY always yields a higher amount.

Crypto investors can fund liquidity pools on exchanges, store cryptocurrency in savings accounts, stake their coins, or invest in yield farms. Understanding the difference between APY and APR is crucial for knowing where to best invest money. From a practical perspective, APR is advantageous for borrowers. However, those looking to invest should consider APY rates to maximize their profits.

Considering that more DeFi tools and cryptocurrencies use APR, investors need to manually compound interest, meaning they must reinvest their profits daily or weekly to achieve a more significant compound interest.

Advantages of APY over APR for Crypto Investors

- More Accurate Reflection of Earnings: APY provides a true picture of potential earnings by including compound interest.

- Importance of Reinvesting: To maximize returns, reinvesting and leveraging compound interest are vital strategies.

Final Thoughts

Understanding the difference between APR and APY in Crypto is essential for making informed investment decisions. For investors, APY is a more accurate measure of potential returns, while APR is more relevant for borrowers. By leveraging APY, investors can better assess the benefits of compounding interest and optimize their investment strategies.

Since the annual percentage rate is calculated on a yearly basis, it can be more advantageous for borrowers seeking better rates than investing in crypto assets and hoping for returns.

However, since APY includes compound earnings, it is more beneficial for investing in crypto assets, providing a more accurate representation of potential earnings.

Understanding whether returns or payments are based on the annual percentage rate or the annual percentage yield is crucial when investing or borrowing. Given the nature of the cryptocurrency market, yields are often higher than in the traditional financial sector, but so are the risks.

Understanding whether returns or payments are based on the annual percentage rate or the annual percentage yield is crucial when investing or borrowing. Given the nature of the cryptocurrency market, yields are often higher than in the traditional financial sector, but so are the risks.

Also read: How to Find an Altcoin That Will Bring 1,000% – Best Crypto to Buy

FAQ: Understanding APR and APY in Crypto

What is APR in the context of cryptocurrencies?

APR, or annual percentage rate, measures the cost of borrowing or the return on investment without considering compounding effects. It helps calculate the yearly cost of a loan or the annual return on an investment.

How is APR different from APY?

APR calculates interest based on simple interest, while APY includes compound interest. APY provides a more accurate representation of potential earnings because it accounts for interest on both the initial principal and the accumulated interest.

Why is understanding APR and APY important for crypto investors?

Understanding APR and APY helps investors make informed decisions by comparing the true costs of borrowing and the actual returns on investments. APY is particularly crucial for evaluating the benefits of compounding interest in crypto investments.

How can investors earn APY on their cryptocurrencies?

Investors can earn APY by staking their coins, participating in yield farming, or using crypto savings accounts. These methods allow investors to earn interest on both the initial deposit and the accumulated interest.

What is an example of calculating APR in crypto?

Suppose you lend 1 ETH on a DeFi platform offering a 12% APR. At the end of the year, you would receive 0.12 ETH as interest.

Interest=1 ETH×0.12=0.12 ETH

How is APY most useful for crypto investments?

APY is more of a tool in the case of crypto investments because it does involve compound interest, thus giving a more realistic view of what potential earnings are over time. This helps very well in providing the investor the best way to maximize their return.

What does a 7-day APY in cryptocurrency refer to?

A 7-day APY will yield the APY based on the amount of interest accrued over seven days annualized. Therefore, it estimates the possible annual return if the rate of return for the week was maintained.

Now, how is it that compound interest favors the investor?

Very simply, compound interest is when the investment starts gaining interest on the principal – and on the interest that has already been accrued, over time. This is how an investment grows exponentially.

Why would a crypto investor prefer APY instead of APR?

APY gives a more realistic viewpoint of earning potential through compound interest, incentives for reinvesting, and makes the most of compound interest; it is a better measure for assessment of potential investments in the crypto market.